January 2022 Market Update

By Gary Lucas

January saw financial markets take quite a battering, resulting in a fall in the value of our funds, which is reflected in our monthly performance statements. However, context is always important, so despite this drop, it's essential to keep in mind our impressive performance over the course of a turbulent couple of years.

On some days last month, share markets rose dramatically upwards before falling just as hard. This involved moves up or down by 1%, 2% or even 3%, yet often finishing in the opposite direction. However, by the end of the month, the massive swings landed in an unfavourable position.

Such extreme volatility is unusual. And its impact over the month resulted in the US S&P 500 index (which covers the largest 500 companies) losing 5.26%, and the ASX 200 losing 6.35%.

The good news is that both of our portfolios defended well, with the DMG Diversified down just 3.29% and the Clearwater Dynamic Portfolio down 3.78%. Once again, these results prove our ability to invest strategically. Our tried and tested approach limits losses even in the most turbulent markets while still delivering strong, long-term returns.

Again, context matters - and it's important to remember that we've been fortunate during recent years. Over the last decade, market volatility has been far less extreme than usual. There have, of course, been periods when volatility has been high. Nonetheless, overall, the last ten years have been relatively stable and positive. However, it's also essential to bear in mind that the previous low level of volatility was unusual in itself – a phenomenon created by declining interest rates reaching historic lows, which then stayed low for quite some time.

Now that interest rates are increasing, it's impacting the financial markets. But there are other factors involved that have contributed to the volatility. For example, we need to consider the extremely high share prices we saw before the recent falls, company profit updates, and the inflation raising supply-chain issues we’ve been seeing of late. On top of this, we must weigh in the impact of government-mandated Covid restrictions and the current situation in Russia and the Ukraine. Having said that, even though these matters impact heavily on investor sentiment, it is interest rates that are the crucial factor.

In fact, despite dramatic headlines and widespread uncertainty taking its toll on the market, what we're really seeing is a normalisation of interest rates. In Australia, the interest rate set by the Reserve Bank is still sitting at an emergency rate of 0.1% - an abnormally low level – which is why we believe an increase to around 2% or higher in one to three years isn't going to alarm anyone.

What's more, increasing interest rates will lift both term deposit and loan rates, benefiting investors elsewhere in their portfolios but hurting borrowers. However, at this point, the main issue we face is how the current uncertainty will play out before we reach a point where interest rates will remain stable for a while.

In an ideal world, central banks will introduce regular increases of around 0.25% with clear advance warnings to reduce the surprise factor. Conversely, the worst-case scenario would be an unexpected announcement of, say, a 0.50% increase. However, the likelihood of this latter scenario materialising is currently being canvassed in the media, so it’s a possibility that’s now well and truly on the table.

All things considered, it appears that banks in both the US and Australia will take a gradual approach, ever mindful of keeping inflation under control in order to support economic growth and achieve full employment.

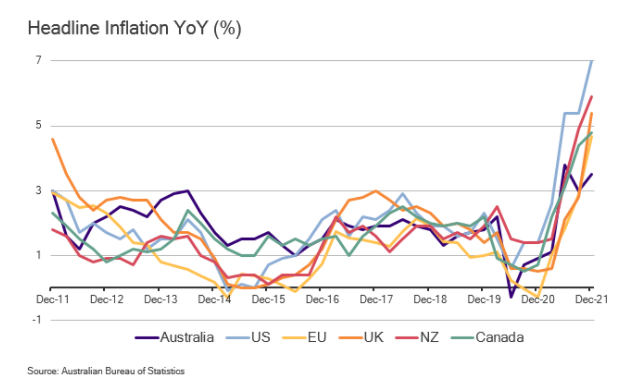

Meanwhile, inflation is driving higher interest rates. We saw increases in the UK and New Zealand last month, and there's much debate surrounding when Australia will follow suit. Much has been written about inflation over recent months, not least because it has been sitting at historic lows. But now that we’re emerging from Covid restrictions and world economies are bouncing back, inflation is reaching levels well above the recent average.

Clearly, the cycle of low inflation has now ended. And if left unchecked, we’ll see price increases that’ll be bad on our pockets, bad for business and bad for the economy in general. The chart below clearly illustrates the profound significance of the recent inflation changes.

As you know, the standard approach to reducing inflation is to increase interest rates. Therefore, we can see the current uncertainty surrounding inflation is feeding through to interest rates, causing concern for investors. This is the reason why we’re seeing the markets fall. In addition, there are fears that central banks will not act quickly enough to combat inflation. And if that fear becomes a reality, drastic action will be needed to limit more significant increases.

However, if you think raising interest rates will solve the problem, it won't. Instead, what will happen is that the commentary will quickly turn to the possibility of a recession because interest rates have risen too high, too fast. And that, in itself, will slow the economy.

Unfortunately, as we often say, there's always something to worry about in the financial markets, and if it's not immediately obvious what that is, someone will find something!

Having said that, it's important to understand that central banks may continue to adjust interest rates. But they don't want to derail the economy - they’re just being careful. Of course, you might think they're being too cautious. But it's important to remember that the ideal outcome is the Goldilocks solution. An increase in interest rates that's just high enough to keep the world economies ticking along nicely while slowing down inflation at just the right pace to keep it under control and well within targets.

It's also crucial to remember that central banks have access to all the information they could possibly need. On top of that, they have teams of highly experienced people crunching numbers on a full-time basis. These experts won’t get the timing absolutely spot on. But that's not to be expected in finance because no one will ever consistently get things right!

What's crucial to understand is that we're experiencing a substantial shift in the market. We're making the transition from decades of low-interest rates to an era where increasing interest rates will dominate. We can't expect this to be a smooth transition, which is why we're currently seeing such a high rate of volatility.

Furthermore, it's improbable that the drops in the share market have come to an end. That said, falls of the size we've seen so far occur reasonably regularly. In fact, financial markets often fall 10%, while as recently as late 2018 and early 2020, we saw falls of 20% or more. Nonetheless, markets do tend to overshoot in both directions, so when they fall, they fall hard, which also has the positive effect of creating new buying opportunities.

At Clearwater, we always ensure that our portfolios are well diversified. We hold assets across various asset classes, including a number that we expect to keep their value, some less likely to fall, and some that may even make money.

Currently, we're busy reviewing our allocation. This work involves re-considering our holdings, meeting with fund managers, and doing everything we possibly can to defend your investment against future falls. Our aim is always to see a strong recovery when the markets inevitably pick up again.

We have an excellent long-term track record of limiting losses, and despite January being a topsy turvy month, our results speak for themselves. As always, we will keep you posted on any changes to our approach as we focus on finding new ways to keep your investment working hard for you during these challenging times.